kentucky car tax calculator

Sales tax in the Kentucky is fixed to 6. On the drivers side of the dashboard viewable through the windshield in the Drivers side door jamb looks like a sticker.

Car Tax Disc Changes Five Facts You Never Knew About Your Almost Obsolete Tax Disc The Independent The Independent

US Sales Tax calculator Sales Tax calculator Kentucky.

. Depending on where you live you pay a percentage of the cars assessed value a price set by the state. The base state sales tax rate in Kentucky is 6. In the case of new vehicles the retail price is the total consideration given The consideration is the total of the cash or amount financed and the value of any vehicle traded in or 90 of the manufacturers suggested retail price MSRP including.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by the Commonwealth. If youre a new employer youll pay a flat rate of 27. Kentucky vehicle tax calculator.

All rates are per 100. Actual amounts are subject to change based on tax rate changes. A 200 fee per vehicle will be.

Our free online Kentucky sales tax calculator calculates exact sales tax by state county city or ZIP code. All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property. 2022 Kentucky state sales tax.

Hmm I think. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Sales Tax Calculator Arkansas Car and Similar Products and.

Remember paying your SUI in full and on time qualifies you to get a whopping 90 off of your FUTA tax bill so make sure you pay attention to the due dates. Dealership employees are more in tune to tax rates than most government officials. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Kentucky Vehicle Property Tax Calculator. Kentucky Alcohol Tax. Kentucky Property Tax Rules.

The percentage paid is labled a Usage Tax In our calculation the taxable amount is 39175 which equals the sale price of 39750 plus the doc fee of 475 plus the extended warranty cost of 3450 minus the trade-in value of 2000 minus the rebate of 2500. Geschreven door op februari 13 2021. Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1st of each year.

Where can I find my Vehicle Identification Number VIN. Kentucky vehicle tax calculator. Please enter the VIN.

You can do this on your own or use an online tax calculator. Worden wie ik ben mijn verhaal mei 10 2019. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky.

In Kentucky the sales tax applies to the full price of the vehicle without considering trade-ins. Payment shall be made to the motor vehicle owners County Clerk. Every year Kentucky taxpayers pay the price for driving a car in Kentucky.

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. If you are unsure call any local car dealership and ask for the tax rate. Therefore car buyers get a tax break on trade-in vehicles and rebates in Kentucky.

Car tax as listed. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. PDF Vehicle Use Tax and Calculator Questions and Answers Sales tax.

356 Big Hill Avenue Richmond KY 40475 859-624-2277. Property taxes in Kentucky follow a one-year cycle. The tax estimator above only includes a single 75 service fee.

Unless youre in construction then your rate is 10. Your household income location filing status and number of personal exemptions. Kentucky Income Tax Rates for 2022 Estimated tax title and fees are 0 Monthly payment is 384 Term Length is 72 months and APR is 7.

Motor Vehicle Operators License. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The wage base is 11100 for 2022 and rates range from 05 to 95.

Kentucky has a 6 statewide sales tax rate but also has 226 local tax jurisdictions including cities towns. Motor Vehicle Usage Tax. 2000 x 5 100.

It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. Estimate your car payment with our simple to use Loan Calculator. For example you could trade-in your old car and receive a 5000 credit against the price of a 10000 new vehicle making your out-of-pocket cost only 5000.

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Once you have the tax rate multiply it with the vehicles purchase price. Find your Kentucky combined state and local tax rate.

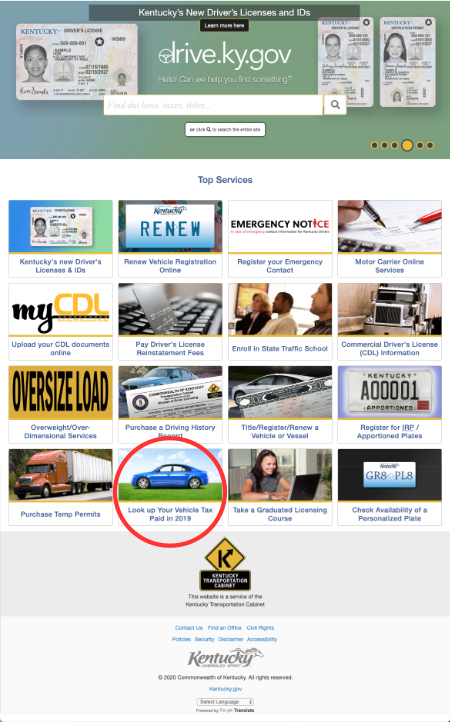

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. Kentucky VIN Lookup Vehicle Tax paid in 2021. Kentucky has a 6 statewide sales tax rate but also has 211 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0008 on top.

Overview of Kentucky Taxes. You can find the VIN. By using the Kentucky Sales Tax Calculator you agree to the.

Kentucky sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Search tax data by vehicle identification number for the year 2021. Multiply the vehicle price before trade-ins but after incentives by the sales tax fee.

On average homeowners pay just a 083 effective property tax. It is levied at six percent and shall be paid on every motor vehicle. The tax is collected by the county.

Please note that we can only estimate your property tax based on median property taxes in your area. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. Thus the taxable price of your new vehicle will still be considered to be 10000.

Local tax rates in Kentucky range from 600 making the sales tax range in Kentucky 600. Please note that this is an estimated amount. Estimate your car payment with our simple to use Loan Calculator.

Contractor Payroll Salary Packaging Novated Leasing Contractor Payroll Services Http Kentucky Nef2 Com Contracto Payroll Managing Your Money Contractors

Liberty Tax Service Bookkeeping Tax Services Colorado Springs 481 Hwy 105w Suite 201 Monument Debt Relief Programs Credit Card Debt Relief Budgeting Money

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Which U S States Charge Property Taxes For Cars Mansion Global

What S The Car Sales Tax In Each State Find The Best Car Price

Rising Value Of Vehicles May Lead To Property Tax Increase In Kentucky News Wdrb Com

4 Things Every Borrower Needs To Get Approved For A Mortgage Loan In Kentucky Fha Va Khc Conventional Mortgage Loan In 2018 Mortgage Rates Today Mortgage Loans Conventional Mortgage

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Credit Repair Jersey City Non Profit Credit Repair Near Me Top 10 Best Cre Credit Repair Business Credit Repair Credit Repair Companies

Dmv Fees By State Usa Manual Car Registration Calculator

Sales Tax On Cars And Vehicles In Kentucky

Registration Fees Penalties And Tax Rates Texas

Dmv Fees By State Usa Manual Car Registration Calculator

2020 Vehicle Tax Information Jefferson County Clerk Bobbie Holsclaw

Kentucky Used Car Prices Taxes Jump 40 Start 2022 Fox 56 News