heloc draw period payment calculator

Most HELOCs let you withdraw money for as long as 10 years and then offer an even longer repayment period usually up to 20 years. Also check out the Advanced Loan Payment Calculator for even more options.

Heloc Calculator Calculate Available Home Equity Wowa Ca

Try out the free online monthly payment calculator today.

. Discover Home Loans offers 10 15 20 and 30 year home equity loans in amounts from 35000 to 300000. Generally HELOCs come with a repayment period between 10 20 years attached. A HELOC is similar to a revolving charge account where you can borrow from the line of credit as you need cash over the course of whats known as the draw period.

HELOCs typically have a draw period of up to 10 years and a repayment period of up to 15 years beyond the draw period. The monthly payment for a HELOC is divided into two phases based on the point of time during the HELOC. During the draw period you can borrow from the credit line by check transfer or a.

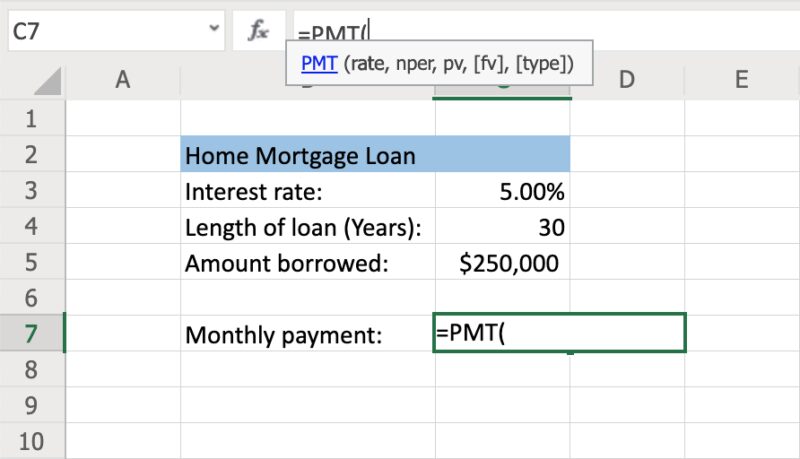

The repayment period can be either fixed or adjustable rate. The term of your loan dictates whether you. The Monthly Payment Calculator will calculate the monthly payment for any loan if you enter in the total loan amount the number of months to pay off the loan and the loan annual interest rate.

In terms of the HELOC you typically only need to make interest repayments during the draw period which is usually between 10-15 years. Like a credit card with a HELOC you can take money from the loan when you need to and make only minimum payments during the draw period. The repayment period is up to 20 years following a 10-year draw period.

Its OK to estimate if you arent sure. Monthly Interest Only Payment CHB RATE. However this product contains an additional draw feature.

The interest-only repayment option is an attractive feature of a HELOC. Following the draw periods expiration the repayment period begins. For the loan.

During your repayment period youll no longer have access to funds via the HELOC and will be required to make monthly payments until the loan is fully paid off. Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin. The HELOC Payment Calculator uses the following formulas.

As the borrower repays the balance on the line the borrower may. The Repayment Period. Some HELOCs allow you to make an interest-only payment.

The APR will vary with Prime Rate the index as published in the Wall Street Journal. Lenders typically loan up to 80 LTV though lenders vary how much they are willing to loan based on broader market conditions the credit score of the borrower. Later at the end of the draw period usually 5-10 years your monthly payment will.

In a home equity line of credit the repayment period is the portion of the loan term that follows the draw period. Estimated monthly payment shown reflects the interest-only payment during the Draw Period only. During the repayment period your minimum monthly payment will be an amount necessary to repay the outstanding balance over the repayment period based on the APR in effect at the start of this period.

Enter the amount you plan on withdrawing during the draw period. Thats why a HELOC is listed as a revolving account. HELOC amounts range from 25000 to 500000.

Unless you make payments toward your principal during. A HELOC has two phases. Long draw and repayment periods.

Heres how to calculate your HELOC payment. 4 A Fixed-Rate Loan Option FRLO allows you to convert an outstanding variable rate HELOC balances to a fixed rate loans which results in fixed monthly principal and interest payments at a fixed interest rate. Home equity line of credit HELOC is an open-end product where the full loan amount minus the origination fee will be 100 drawn at the time of origination.

2 Guaranteed Rate Inc. Prime Rates are set by the lenders and can differ from institution to insitution. As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months.

A draw period during which you can borrow against the line of credit as you wish and a repayment period during which you must repay the money youve borrowed. Lease or Buy Equipment Calculator. The repayment period is when you have to start paying back the principal.

If rates increase after the repayment period begins your monthly payment will increase so that the balance is fully repaid at maturity. You have to be prepared for this or. Fixed-Rate Loan Option monthly minimum payments The minimum amount you will need to pay each month on your home equity line of credit Fixed-Rate Loan Option.

For a HELOC the interest rate is typically a lenders prime rate 05. HELOCs are usually set up as adjustable-rate loans during the draw period but often convert to a fixed-rate during the repayment phase. For the loan amount.

Additionally as long as you pay at least 99 in interest on your line of credit during the year you wont pay an annual fee also 99. During this time you also have the option to make payments back against the principal. A HELOC has two phases.

After the draw period there is a repayment period during which time. Use our HELOC calculator to find out how much you could borrow with a home equity line of credit. The initial amount funded at origination will be based on a fixed rate.

So if a lender increases its prime rate then your HELOC interest payment increases. This means unlike the fixed payments in a fixed-rate mortgage a HELOCs rate is variable. The third column can be thought of as the draw period on a HELOC where the homeowner is making the minimum monthly payment.

First the draw period which is usually 10 years followed by the repayment period which is usually 15 years. Our HELOC payment calculator provides the monthly payment required for a home equity line of credit HELOC. On a HELOC with a 35000 balance an interest-only payment is about 85 per month lower than a 20-year fully-amortized payment a common amortization period for HELOCs that require a fully amortized payment.

During the draw period you will usually have the option of making interest-only payments. However at the end of the draw period the interest and principal will be rolled into one amortized monthly payment for a loan term of 15 years. Dont enter your total credit limit unless you plan on using the full amount.

The draw period and the repayment period. At todays rate a 25000 10-year HELOC would cost a borrower approximately 114 per month during the 10-year draw period. HELOC Payment Calculator For a 20 year draw period this calculator helps determine both your interest-only payments and the impact of choosing to make additional principal payments.

Heloc Payment Calculator With Interest Only And Pi Calculations

Heloc Calculator How To Make Use Of It To Save Money Homeequity Bank

Heloc Calculator How To Get To Your Payoff Date Youtube

What Is A Bridge Loan A Way To Buy A New Home Before You Sell The Old One Bridge Loan Real Estate Investing Rental Property Buying A New Home

Heloc Loan Calculator Store 55 Off Www Ingeniovirtual Com

Line Of Credit Payment Calculator Discount 54 Off Www Ingeniovirtual Com

Tips For Picking A Loan Term For Your Home Mortgage Home Mortgage Mortgage Mortgage Tips

Line Of Credit Payment Calculator Factory Sale 51 Off Www Ingeniovirtual Com

Heloc Loan Calculator Store 55 Off Www Ingeniovirtual Com

Home Equity Line Of Credit Qualification Calculator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Heloc Loan Calculator Store 55 Off Www Ingeniovirtual Com

How To Calculate Monthly Loan Payments In Excel Investinganswers

Heloc Payment Calculator With Interest Only And Pi Calculations Home Improvement Loans Home Equity Loan Heloc

Mortgage Vs Home Equity Line Of Credit Custom Daily Spreadsheet Drawbridge Finance

How To Calculate Equity In Your Home Nextadvisor With Time

Line Of Credit Interest Calculator Deals 54 Off Www Ingeniovirtual Com